Trust Exchange Blog

What's New and Exciting at Our CompanyTrust Exchange Announces Strategic Partnership with HUMAN Protocol and HephAI to Revolutionize Business Information and Data Analytics Industries

Media, PA; March 7, 2024 – Trust Exchange, a leading innovator in the business information and data analytics sector, is thrilled to announce a groundbreaking partnership with HUMAN Protocol, a decentralized, open-source platform renowned for completing over 2...

Peer to Peer Risk Assessment

The value and scale of Peer to Peer (P2P) networks is well known. There are several examples of very successful uses of this framework including Skype, Kazaa, Napster etc. The emergence of “social” software and web 2.0 infrastructures is largely based upon the core...

The Blind Side of Business Risk

Most small and medium businesses manage credit from one angle: by running a cursory check on their prospective customers. If businesses research credit or viability at all, it is one of the last steps in the sales process, just before or during contract negotiation....

Decentralizing Business Information

The process of collecting and monitoring business information is broken, laden with middlemen who don’t add value and yield less than perfect information. One of the most compelling aspects of Internet companies is their ability to eliminate the number of parties...

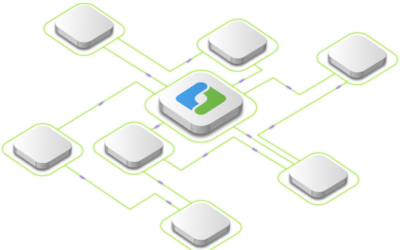

Unlocking Growth Potential: How Collaboration Platforms Empower Community Banks through Compliance and Cost Reduction

In an increasingly digital banking landscape, community banks face a range of challenges, including the need to maintain compliance, reduce costs, and focus on revenue-producing activities. Collaboration platforms can be instrumental in addressing these challenges,...

Crowdsourcing vs. AI for Risk Management: Unlocking the Power of Collective Intelligence with Trust Exchange Collaboration Networks

In today's dynamic world, effective risk management is essential for organizations to navigate the complexities of an ever-evolving landscape. While artificial intelligence (AI) has shown promise in addressing risk management challenges, the unparalleled potential of...

Empowering Credit Unions: How Trust Exchange Tackles Compliance and Vendor Risk

One of the biggest problems facing credit unions today is the ever-changing regulatory landscape. Credit unions must comply with a wide range of federal and state regulations, including consumer protection laws, data privacy requirements, and anti-money laundering...

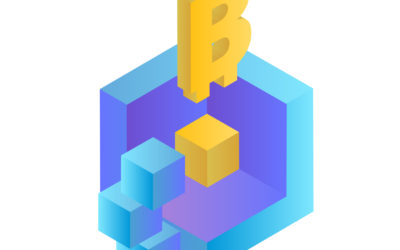

Trust Exchange Tokenized Digital Certifications

The Business Information industry is an $800 billion industry. Companies of all sizes and industries use Business Information for marketing, sales, compliance, and many other strategic business functions. Traditionally, collecting this information is outsourced to the...

Fintech vs. Regtech

What is the difference between the terms fintech and regtech? Both terms are generously applied to banking and financial services industries and regtech is often assumed to be a subset of fintech. Additionally, they seemed to be applied to banking and financial...

Trust Exchange and EpiCentric Consulting Launch ESG Joint Venture

Trust Exchange and their partner EpiCentric have announced a joint venture, EcoCertify, to help companies manage ESG compliance. PHILADELPHIA - November 18, 2022 Trust Exchange, a collaborative compliance platform, today announced that it is launching a new product...

Trust Exchange Announces Partnership With Bankers Helping Bankers Platform

Bankers Helping Bankers to launch a collaborative vendor management platform, powered by Trust Exchange, in late 2022 AUSTIN, Texas, Oct. 05, 2022 -- Today Bankers Helping Bankers (BHB) announced a partnership with Trust Exchange, a collaborative compliance solution,...

Trust Exchange Announces Partnership with Strategic Risk Associates

Strategic Risk Associates enhances Watchtower’s vendor management platform, now powered by Trust ExchangeJune 7, 2022 - Trust Exchange, a collaborative compliance platform, today announced that it islaunching a partnership with Strategic Risk Associates (SRA), to...

Trust Exchange Expands Their Financial Service Offerings by Teaming With CBIZ Risk Advisory Services Group

Trust Exchange announces its official collaboration with CBIZ Credit Risk Advisory Services Group ("CBIZ CRAS") to bring new products and services to its client base. PHILADELPHIA, May 18, 2022 (GLOBE NEWSWIRE) -- Today, Trust Exchange announces its official...

Startup Trust Exchange Raises $4M in Funding

Software platform Trust Exchange raises $4 million dollars from a network of experienced venture capitalists and private family offices. This fresh infusion of capital will be used to grow the team, advance its technology platform and expand sales and marketing...

Trust Exchange Reveals Spring 2022 Release to Power Partnerships and Speeds Time to Revenue

Trust Exchange Spring 2022 Release focuses on partner enablement. Partnerships are a key part of the Trust Exchange ecosystem and the Spring 2022 release provides more tools for branding, integration, implementation, and scale. The goal with this new release is to...

Back to the Future: Block Chain and 1998

For the past few years, I’ve been following the reaction of the mainstream market to the advent of and applications of blockchain and it reminds me of 1998 when the Internet was about to “cross the chasm.” Executives in banking, pharma, and healthcare (among others)...

Eliminate Business Information Middlemen

The process of collecting and monitoring business information is broken, laden with middlemen who don't add value and yield less than perfect information. One of the most compelling aspects of Internet companies is their ability to eliminate the number of parties...

How Do Companies Build Longterm Health?

Managing companies for success across a range of time frames — a requisite for achieving both performance and health — is one of the toughest challenges in business today. Turbulent economic conditions have concentrated the collective minds of many executives on pure...